Table of Content

An insurance binder is required in this situation.Mortgage lenderswill often ask you to prove that you have home insurance. A binder is proof of coverage if you haven’t received your policy documents. It’s a good idea to follow up with your insurance company or agent if your insurance binder is about to expire and you haven’t received your official policy documents. An insurance binder is a temporary contract offering you, the binder holder, insurance coverage while you’re waiting for the formal insurance coverage to kick in.

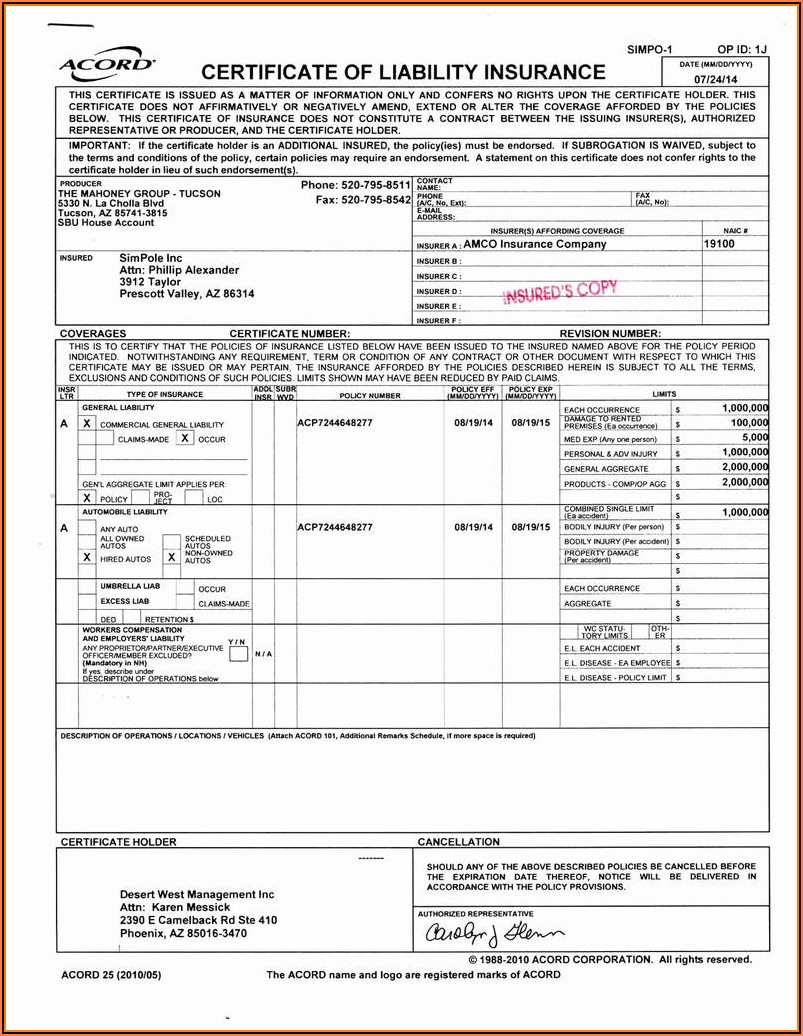

You want as much information as possible about your policy's risks in your binder. You should have this information in your binder as it will streamline the closing process and allow you to evaluate your insurance quickly. An insurance binder is needed when you wait for a new policy to be underwritten, as it serves as proof of insurance before receiving your policy. The name of the insurance company providing coverage is listed in the document. Since there are many levels of coverage available for homes, the insurance type must be listed to avoid errors.

Identity of Insured

You need more than 60 days to find another insurance carrier so your insurer issues a binder extending your policy for an additional 60 days. A binder may be issued by an insurance company or an insurance agent on the insurer's behalf. Agents can issue binders only if the insurer has afforded them binding authority . Insurance brokers have no binding authority because they don't serve as representatives of insurers.

For example, your name will most likely be listed as the owner of the property. Other names listed are other owners of the property such as your partner . The binder will also include the name of the mortgagee such as your bank or financial institution.

Supplemental Insurance

While it's used to provide evidence of insurance, it's not an insurance policy and doesn't provide any coverage. It's simply a summary of the coverages and limits included in the policy. A binder is issued when a policyholder wants or needs evidence of insurance coverage. For example, say the owner of a landscaping business recently acquired a truck and has insured the vehicle under a new business auto policy. The policy hasn't been issued yet, so the owner needs a binder to register the truck with the state's motor vehicle department.

Your home insurance binder provides proof of insurance until the policy is underwritten. If you haven’t received your policy when it nears time for the binder to expire, it’s important to contact your insurance agent to learn why. As soon as you receive the complete policy, you no longer need your insurance binder. Your insurance binder will include all of the information your mortgage lender needs to understand your insurance coverage. When you receive the document, read it thoroughly to ensure it contains the following details.

Having a hard time finding cheap home insurance in Canada?

We can help you with a new home purchase or the insurance requirements of refinancing an existing loan. However, because binders still provide coverage, the insurance company is required to send you a notification of cancellation in advance. It’s a good idea to check with your local agent as this can vary by state. The article below will discuss what’s included in a homeowners insurance binder, what it can be used for and how to get one from your insurance company. If you haven't received your official documents, and your insurance binder is about to expire, you'll want to follow up with an insurance agent.

A home insurance binder can help you to apply for financing, buy a house, andfile a claimeven though you don’t yet have a formal policy. If you are purchasing new insurance, it is a good idea to request a binder. Typically, a home insurance binder will include the name of the insurance agency or agent and the name of the insurance company you purchased coverage through. Your homeowners insurance binder will contain all of the policy details of your homeowners insurance, and act as your proof of insurance for a potential lender. An insurance binder shows the agreement made between you and the insurer. The binder is proof of insurance that you can use until you receive your actual plan.

If you need to provide proof of insurance before receiving your finalized policy, you can utilize your insurance binder letter. Name of Agent – Includes the name of the insurance agent who issued the binder. It also includes a disclaimer indicating that the binder is a subject to the terms and conditions of the policy.

If your insurance policy is not available at the time of loan issuance, you can provide evidence of insurance to the bank or lender with an insurance binder. Ahome insurancebinder, also known as bind coverage or bind coverage, is a set legal papers that establish the agreement between you and your insurer. Binders for insurance typically last 30 to 90 days, and do not provide coverage once they expire.

If you need to provide your mortgage lender proof of insurance but your policy hasn’t been issued yet, you’ll need an insurance binder to prove to them that your home is insured. Additionally, the contract should include the information listed below. A binder is not the same thing as an Insurance Declaration Page which is typically interchanged. Insurance binders are 30- to 90-day, temporary insurance contracts that prove you have coverage while you wait for the official policy documents. Read on for more information about how these binders work and how to get one if you need it.

Aninsurance binderis temporary proof of coverage while you wait for the official issuance of yourhomeowner insurance policy. Certain types of insurance coverage are necessary for you to purchase a home. Your insurer will issue you a home insurance binder if you don’t have standard insurance coverage. An insurance binder is temporary proof of coverage and evidence of the insurance policy.

This will be used to repair or rebuild your physical home if it’s damaged or destroyed by a covered loss. An important part of buying a home is figuring out the different types of insurance you may need. A binder is subject to all the terms of the pending contract, unless it is noted otherwise. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

No comments:

Post a Comment